India’s super-rich are Investing in Luxury Items by INDIAN Wealth Report 2023-24INDIAN Wealth Report 17% Invest in Luxury Items

Nearly 17% of India’s super-rich, those with a net worth of $30 million and above, invested in coveted collectibles in 2023, according to ‘The Wealth Report 2024’ by Knight Frank.

Real estate remained a preferred choice for investment, with 32% of super-rich Indians opting for property investment last year.

India’s booming economy has led to a surge in investments among the super-rich, particularly in expensive watches, art, and luxury collectibles.

Opulent symbols of wealth like Rolex watches and MF Husain artworks offer both status and potential returns.

Rare timepieces and exquisite artworks provide diversification opportunities for India’s 1%, who control 40% of the nation’s wealth.

Expensive watches topped the list of luxury investments for super-rich Indians in 2023, followed by art and jewelry.

Globally, art was the preferred luxury investment, followed by watches and classic cars, contrasting with India’s preferences.

Wine and rare whisky were also invested in but less than global counterparts, with real estate not considered a luxury investment.

Shishir Baijal, chairman and managing director of Knight Frank India, attributed the growth to Indians’ long-standing appreciation for collectibles.

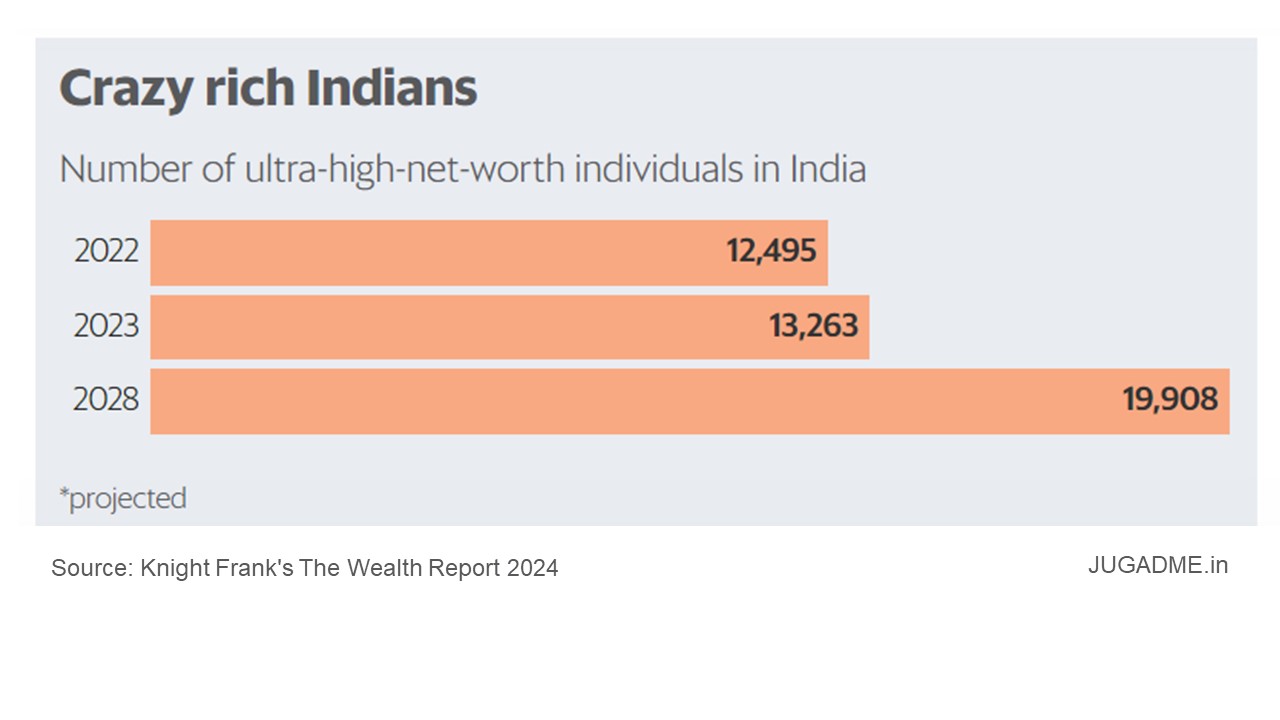

The number of ultra-high-net-worth individuals (UHNWIs) in India grew by 6.1% in 2023 and is projected to increase by 50% in the next five years, outpacing the global average.

Globally, the number of wealthy individuals is expected to grow by 28.1% by 2028.

About 90% of Indian UHNWIs expect their wealth to increase in 2024, with 63% anticipating growth by more than 10%.

32% of India’s UHNWIs have invested in real estate, with nearly 14% of their residential portfolio located outside India.

12% of Indian UHNWIs purchased a new home in 2023, with a similar percentage planning to do so in 2024, below the global average.

The average Indian UHNWI owns 2.57 homes, with 28% renting out their second homes in 2023.

Knight Frank’s Luxury Investment Index revealed that art was the best-performing asset in 2023, with an 11% price increase.

Rare whisky remains a long-term valuable asset, generating 280% returns over the past decade.

Although Auction houses saw record-breaking sales in 2023, the luxury investment index dipped slightly by year-end, attributed to market correction rather than major concern.